51+ how much of your income should go towards mortgage

Web Once the average income is determined a mortgage lender will confirm the DTI and recommend an eligible monthly mortgage payment. Our Experts Are Committed To Helping Customers Find Their Best Home Loan Solution.

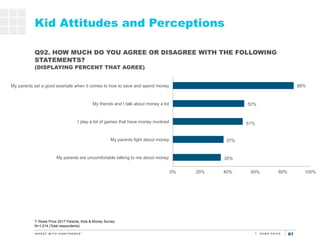

T Rowe Price Parents Kids Money Survey

Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and.

. Web Next take the total and multiply it first by 028 and then by 036 or 043 if youâre angling for a qualified mortgage. Keep your total monthly debts including your mortgage payment at 36 of your gross. Easily Compare Mortgage Rates and Find a Great Lender.

Search For Mortgage Loans Now. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. This means that if your household brings in.

A lender suggests to not. Ad Find Mortgage Loans. Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule.

Ad Ready To Apply. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. First Time Home Buyer.

Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment. Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two. Web The 2836 rule stipulates that in order for a home to be considered within your budget your housing expenses such as mortgage payments taxes and insurance.

Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just. For example if you and your partner have a. With a Low Down Payment Option You Could Buy Your Own Home.

Ad More Veterans Than Ever are Buying with 0 Down. Trusted VA Home Loan Lender of 300000 Military Homebuyers. With a Low Down Payment Option You Could Buy Your Own Home.

Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. Web Keep your mortgage payment at 28 of your gross monthly income or lower. Web Finally the 25 post-tax model says that your total monthly debt should be 25 or less of your monthly post-tax income.

So for example if your monthly income. Well help you every step of the way via our new online application. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

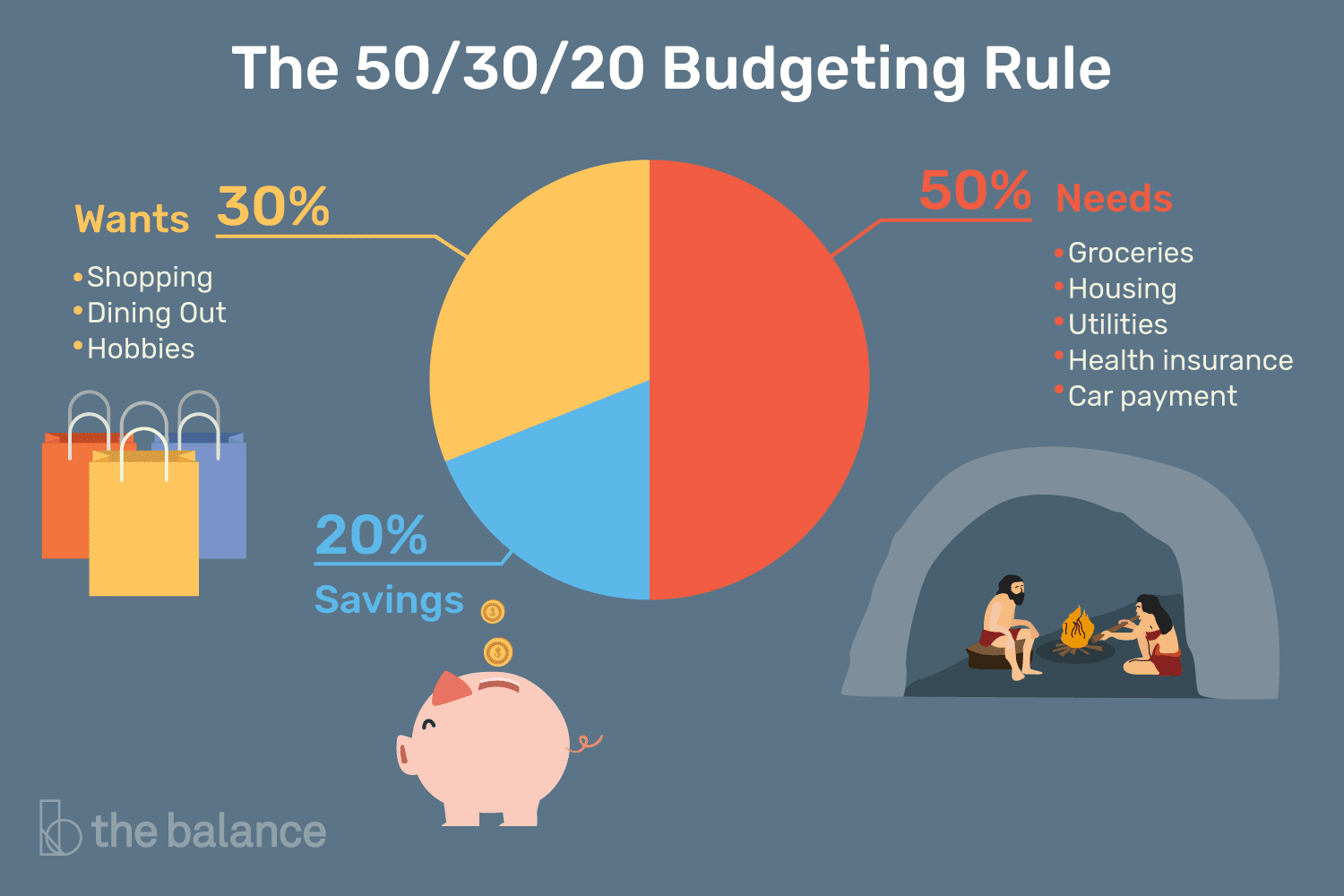

And you should make. Web It recommends you spend up to 50 of your monthly after-tax income aka net income toward essential expenses needs like your mortgage payment utility. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax.

Web A good rule of thumb is that your mortgage payments should be no more than 25 percent of your monthly income. Ad Tired of Renting. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your.

This rule says that you should not spend more than 28 of. Why Rent When You Could Own. However how much you.

Estimate Your Monthly Payment Today. Web How Much Mortgage Can I Afford.

What Percent Of Income Should Go To My Mortgage

Your Credit Score

What Percentage Of Your Income Should Go To Mortgage Chase

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

How Much Mortgage Can I Afford

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

How To Start A Life Coaching Business Thebrandboy

Mortgage Broker In Ballarat Warrnambool Ballan Colac Mortgage Choice

What Percentage Of Your Income To Spend On A Mortgage

Edwards Yeovil

What Percentage Of Income Should Go To Mortgage Morty

Business Quality Award 2022 Winners Adviser Legal General

What Percentage Of Income Should Go To A Mortgage Bankrate

Webinars Canopy

The 50 30 20 Rule A Quick Start Guide To Budgeting

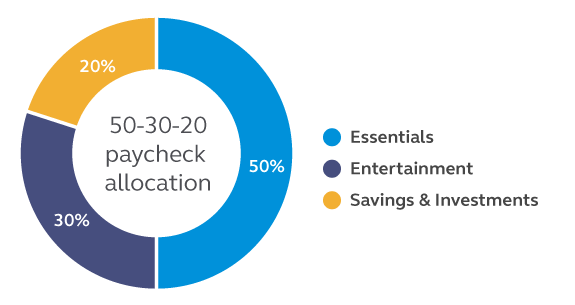

3 Steps To Allocate A Paycheck When You Want To Get Ahead With Your Money Principal Com

How Much Home Can You Afford Advanced Topics